There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

Let's explore some of the most successful traders in the world and learn from their advice. By examining their stories, strategies, and insights, we can gain valuable lessons to apply to our own trading endeavors. Click on each trader's name to dive deeper into their journey and discover the key factors behind their success.

there advice for all.

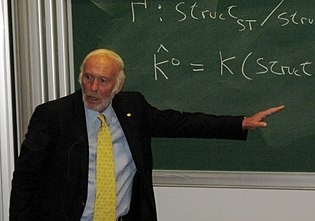

James Simons

Everything’s tested in historical markets. The past is a pretty good predictor of the future. It’s not perfect. But human beings drive markets, and human beings don’t change their stripes overnight. So to the extent that one can understand the past, there’s a good likelihood you’ll have some insight into the future.

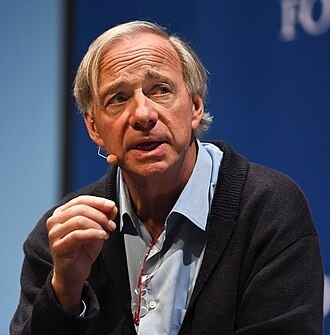

Ray Dalio

I learned to be especially wary about data mining – to not go looking for what would have worked in the past, which will lead me to have an incorrect perspective. Having a sound fundamental basis for making a trade, and an excellent perspective concerning what to expect from that trade, are the building blocks that have to be combined into a strategy.

Steven Cohen

You have to know what you are, and not try to be what you’re not. If you are a day trader, day trade. If you are an investor, then be an investor. It’s like a comedian who gets up onstage and starts singing. What’s he singing for? He’s a comedian.

Paul Tudor Jones ii

Don’t be a hero. Don’t have an ego. Always question yourself and your ability. Don’t ever feel that you are very good. The second you do, you are dead… my guiding philosophy is playing great defense. If you make a good trade, don’t think it is because you have some uncanny foresight. Always maintain your sense of confidence, but keep it in check.

Marty Schwartz

They (traders) would rather lose money than admit they’re wrong… I became a winning trader when I was able to say, “To hell with my ego, making money is more important

Mark D Cook

To succeed as a trader, one needs complete commitment… Those seeking shortcuts are doomed to failure. And even if you do everything right, you should still expect to, lose money during the first five years… These are cold, hard facts that many would-be traders prefer not to hear or believe, but ignoring them doesn’t change the reality

Victor Sperando

The key to trading success is emotional discipline. Making money has nothing to do with intelligence. To be a successful trader, you have to be able to admit mistakes. People who are very bright don’t make very many mistakes. Besides trading, there is probably no other profession where you have to admit when you’re wrong. In trading, you can’t hide your failures.

Ed seykota

There are old traders and there are bold traders, but there are very few old, bold traders.

You